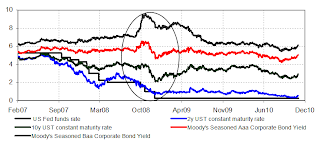

The US Federal Reserve has started their second round of Quantitative Easing which they announced at their last meeting. The first round of QE (and credit easing) was conducted in the wake of the Lehman bankruptcy. At that stage credit yields were rising despite a lower Fed funds rate and lower short-end UST yields (see chart below). These rising yields led to a further worsening of the fundamental situation and increased the risk of corporate bankruptcy which in turn led to higher yields: the negative feedback loop. As a result, the credit/quantitative easing efforts by the US Fed had a significant impact on market pricing and with that on the economy.

US: Negative feedback loop in 2008/09, but not now

Now, however, neither the level of yields nor the availability of liquidity for the banking sector is holding back the economy. Bond yields have been at historic lows (such as for short-term yields) or at least close (at the longer end). Furthermore, credit-related yields are also at historic low levels, be it in nominal as well as in real terms. Additionally, banks continue to hold a significant amount of excess reserves. In turn, the effect of additional liquidity injection by the US Fed’s Treasury purchases on the real economy in the US should be limited. Rather, the economy is suffering from a lack of aggregate demand which could be eased by additional fiscal spending. But for that the political will is lacking. Overall, despite the additional monetary easing, the outlook for the US economy remains for an extended period of limited growth, but I see only a low risk for a double-dip in the next few quarters. Winter promises to see a slight rebound from the weaker numbers of the last months.

In the Eurozone, however, the ECB is keen to continue its exit from the exceptional liquidity support measures. This is also evident in the rising money-market rates. Several prominent members of the ECB/national Eurozone central banks also feel at unease with the historic low ECB repo rate.

Indeed, the overall Eurozone growth environment with growth at a non-annualised 0.4% in Q3 and yoy inflation currently running around 1.9% (1.1% for the core rate) suggests that it could withstand a somewhat less accommodative monetary policy environment. However, this is not how things work in the Eurozone. The Eurozone is a combination of unequal economies with the outperforming economies enjoying the most accommodative monetary environment and the underperforming economies suffering from the most restrictive monetary environment.

Most notably Germany could do with higher yields. It is one of my long-held believes that Germany is at the start of a multi-year high-growth period. Given that Germany has the lowest nominal bond yields, it has currently also the lowest real yields and in conjunction with a healthy growth environment, it is relatively easy for corporates and households to access credit. As Germany is outperforming, its monetary environment becomes even more accommodative, reinforcing the upswing.

Eurozone: Negative fedback loop is still alive (10y yields)

On the other side, for example Ireland has much higher nominal yields and given that it suffers from deflation (yoy inflation stood at -0.8% in October), has extremely high real yields. Furthermore, amid the ongoing deep recession, credit is much more difficult to come by for corporates and households. Both, the restrictive credit environment and the highly restrictive level of real yields are reinforcing the deleveraging process and thereby acting to slow down the economy further. This is debt-deflation at its best and results in a downward spiral with the worsening fundamental environment deferring investors, thereby leading to higher yields and with that to ever stronger deleveraging pressures and so on.For the ECB, this poses indeed a difficult task: The largest economy as well as the Eurozone average would demand a less accommodative environment but the peripheral countries need a more accommodative environment. With the help of their traditional rate setting, they only can lower the level of core bond yields. For the group of peripheral countries where the negative feedback loop is alive, the low repo rate environment has limited effects. If the ECB were up to a more activist stance, it could hike the repo rate but at the same time engage in massive credit (sterilised) or quantitative easing (non-sterilised) via buying of peripheral bonds. With that it would achieve both goals: a somewhat less accommodative environment for the economically sound and well-growing countries but a less restrictive stance for the periphery. Furthermore, the ECB’s support for secondary bond prices would also promote private sector demand for these instruments and limit contagion for other peripheral countries.

So far, the ECB bond buying has been very limited and was thereby not able to break the negative feedback loop. Unfortunately, I only see a low probability that the ECB will seriously step up its bond buying efforts given the prominent adversaries of the existing low-scale buying. Rather it seems likely that we continue facing a re-active ECB which will lead to an even easier monetary environment for the north-east but not the periphery. It should not be the US Fed which is engaging on another round of quantitative easing, it should be the ECB! But as it isn’t, the peripheral countries will continue to suffer from a very restrictive monetary policy environment. For the time being, we can continue to watch the Irish domino fall and once the bail-out has been announced, the focus can shift to Portugal and at a later stage to Spain.

No comments:

Post a Comment