This is my last blog post for the year as I will be hitting the slopes in Switzerland from this weekend onwards.

In my blog post Finally some good news dated December 1, a day ahead of the last ECB meeting, I wrote: "we are likely to get a timid response by the ECB, just enough to improve sentiment towards risky assets in general in the short term but not enough to provide a real lasting solution."In the meantime the amounts the ECB bought during that period have been published. In the week up to Dec 3, EUR1.965bn of bond purchases have been settled and EUR2.667bn during the last week. While this constitutes a clear pick-up in terms of ECB bond purchases compared to the previous weeks/months, it remains too small and far away from what would be needed to provide more than just a very short term pause in the peripheral's downward spiral.

Given that market liquidity is usually drying up in the period leading to XMas and New Year, theses small ECB purchases seem to have been enough to fuel a short covering rally by some dealers in bonds and even more so in peripheral equity markets where for example the Spanish IBEX was able to rally by more than 10%.

However, the underlying problems for the peripheral economies (an unsustainable debt path coupled with a lack of competitiveness) remain. Additionally, the purchases are not large enough to break the adverse feedback loop. The high yields the peripheral countries have to pay render the debt situation even worse - be it for the sovereign as well as for its banks and corporates/households - leading to higher deficit and slowing down growth even more. Furthermore, given the huge volatility in market yields, sticking to peripheral bond positions becomes more difficult even for investors who think that current spreads adequately reflect fundamental risks. As realised volatility rises, the value-at-risk of the peripheral bond positions increases and hence to keep risks in check, the nominal positions has to be reduced nonethless, leading to even higher yields and higher volatility.

I argued previously that a significant increase in ECB bond purchases could help a lot to break this adverse feedback loop. It would for one lower yields (and with that reduce costs for the sovereigns/its banks/corporates/households) and it could also - if done in a more transparent manner than at present - lower market volatility and hence value-at-risk for investors in respective bonds. Both would help to lure investors back into the market.

However, the ECB seems very reluctant to go down that route and seems to keep its buying as low as possible. This is enough to cause some stability in a thin pre-holiday trading environment, but not enough to get through the funding heavy first months of the new year.

As a result, the peripheral downward spiral remains intact and 2011 promises to see Portugal and then Spain to have to revert to the EFSF before the end of Q2. I expect that at that stage a more lasting solution will be found (probably some kind of E-Bond or bond buying programme, however, judging from recent political rhetoric, it will be called differently). If that would still not happen, then Belgium and later Italy promise to be next.

So, for the time being, enjoy the crisis pause the ECB has provided to celebrate XMas and New Year but get ready for the showdown in 2011!

Tuesday, December 14, 2010

Wednesday, December 8, 2010

Just Blame Germany

It has become fashionable to blame Germany for the current crisis in the Eurozone. Most arguments encompass one or more of the following: Germans don't consume enough, Germany has a large current account surplus which hurts the rest of the Eurozone, Germany has conducted a beggar-they-neighbour policy over the past decade via internal devaluation and wage restraint, Germany exerts pressure on the peripheral countries to engage in way too strong deflationary austerity measures which renders their situation even worse, Germany refuses to pay for the periphery via more financial help be it in the form of a substantially larger EFSF or the introduction of EuroBonds, Germany is pushing ahead with its plans to introduce a sovereign default mechanism from 2013 onwards which leads investors to sell their peripheral debt now.

First, the arguments which blame Germany on the basis of their economic behaviour over the past decade seem mostly wrong: yes, Germany has a current account surplus, a relatively high savings ratio/low consumption, a highly competitive economy and it engaged in substantial internal devaluation via wage restraint. What we should not forget though is that a) just as the peripheral countries were profiting from very low real yields during the past decade amid the German economic malaise, Germany suffered from too high real yields amid the periphery's boom which rendered its economic weakness even worse and most importantly b) if Germany would not have done the corporate restructuring/budget consolidation/structural reforms, the German economy would be in a much worse shape at present. It would not be competitive (and therefore not have a current account surplus) and it would have a much larger fiscal deficit. As a result, if Germany would currently not have a current account surplus it could as well not be a net exporter of capital. Furthermore, if it would have a significantly higher fiscal deficit, it would as well suffer from the risk of rating downgrades amid an unsustainable debt path. Given that the German economy constitutes close to 30% of Eurozone GDP, the health of the German economy and the German sovereign is vital for the survival of the overall Eurozone. Would Germany still be economically sick, then approx. 50% of the Eurozone would be mired in deep depression with no one being able to help. It is great news that Germany could overcome its chronic weakness and is now in a state where it can provide stability to the Eurozone periphery.

Looking ahead, it remains my expectation that Germany will continue to outperform in economic terms as domestic consumption can pick up again. The low level of unemployment should lead to increasing real wage gains. Furthermore, the low level of unemployment coupled with the end of the structural reform period leads to an improvement in household sentiment and as a result an increase in the willingness to consume/a reduction in the willingness to save. This is further strengthened by the historically low level of real yields. The combination of a rising sum of wages and a lower savings rate should significantly fuel consumption growth over the next 2-3 years. This will lead to an improving internal balance within the Euorozone and eases the pressure on the periphery to restore competitiveness via significant deflation.

If there is one sensible argument to blame Germany relating to the past decade, then it is that they did not bring their banking system in order. The German domestic banking sector remains highly fragmented and barely profitable, a key reason why German banks have engaged in such massive investments in Eurozone peripheral debts. Would there have been more private banking mergers and would politicians have forced a consolidation of the Landesbanks and a change in their business model, the German banking sector could be much more resilient now. But it is not and that remains the key weak point of the German economy!

Additionally, I also think that to blame Germany for the latest surge in peripheral yields misses the point somewhat. Germany wants to introduce a default mechanism for states from 2013 onwards. Some observers suggest that this is the reason why investors have started to dump their peripheral bond holdings and blame Germany for talking about potential default. However, it is mostly the same obsevers who have been suggesting that there is no way around the perihperal countries defaulting anyway (and maybe leave the euro). The only thing which the German proposal changes is that they want to have an institutional set-up for the limits of Eurozone sovereign solidarity.

Overall, one should also not forget that if Germany does not demand any austerity measures/reforms in exchange for financial support, then nobody will. It seems that the smaller core countries (for example the Netherlands, Austria, Finland) have a similar line as Germany but in the current negotiations dont have the same power. As a result, if Germany were just to bail-out the rest of the periphery then yes, the peripheral debt crisis would be solved for the time being. But the prize to pay would be a massive rise in moral hazard issues, risking an even bigger debt crisis further down the road where no-one would be able to lend support.

Finally, I remain in favour of some sort of Eurobond (I suggested earlier joint issuance for the part of debt being within the Maastricht Treaty criteria) and do hope that Germany will give in on this. But also here, it matters a great deal that incentives to conduct a sustainable fiscal policy and to remain economically competitive become stronger and are not weakened further.

But to repeat: the biggest mistake by Germany is that it did not restructure its German banking sector. Germany is the voice of the fiscally sustainable and economically competitive countries. If these countries do not have this strong voice anymore, then the door to a fiscal union with much higher moral hazard issues as well as a higher propensity towards inflation and a lower propensity towards innovation and productivity is open. Germany has shown that they are able to negotiate, stand back from their toughest demands and support the common currency project if need be and so far it does not look likey they are deviating from that course.

First, the arguments which blame Germany on the basis of their economic behaviour over the past decade seem mostly wrong: yes, Germany has a current account surplus, a relatively high savings ratio/low consumption, a highly competitive economy and it engaged in substantial internal devaluation via wage restraint. What we should not forget though is that a) just as the peripheral countries were profiting from very low real yields during the past decade amid the German economic malaise, Germany suffered from too high real yields amid the periphery's boom which rendered its economic weakness even worse and most importantly b) if Germany would not have done the corporate restructuring/budget consolidation/structural reforms, the German economy would be in a much worse shape at present. It would not be competitive (and therefore not have a current account surplus) and it would have a much larger fiscal deficit. As a result, if Germany would currently not have a current account surplus it could as well not be a net exporter of capital. Furthermore, if it would have a significantly higher fiscal deficit, it would as well suffer from the risk of rating downgrades amid an unsustainable debt path. Given that the German economy constitutes close to 30% of Eurozone GDP, the health of the German economy and the German sovereign is vital for the survival of the overall Eurozone. Would Germany still be economically sick, then approx. 50% of the Eurozone would be mired in deep depression with no one being able to help. It is great news that Germany could overcome its chronic weakness and is now in a state where it can provide stability to the Eurozone periphery.

Looking ahead, it remains my expectation that Germany will continue to outperform in economic terms as domestic consumption can pick up again. The low level of unemployment should lead to increasing real wage gains. Furthermore, the low level of unemployment coupled with the end of the structural reform period leads to an improvement in household sentiment and as a result an increase in the willingness to consume/a reduction in the willingness to save. This is further strengthened by the historically low level of real yields. The combination of a rising sum of wages and a lower savings rate should significantly fuel consumption growth over the next 2-3 years. This will lead to an improving internal balance within the Euorozone and eases the pressure on the periphery to restore competitiveness via significant deflation.

If there is one sensible argument to blame Germany relating to the past decade, then it is that they did not bring their banking system in order. The German domestic banking sector remains highly fragmented and barely profitable, a key reason why German banks have engaged in such massive investments in Eurozone peripheral debts. Would there have been more private banking mergers and would politicians have forced a consolidation of the Landesbanks and a change in their business model, the German banking sector could be much more resilient now. But it is not and that remains the key weak point of the German economy!

Additionally, I also think that to blame Germany for the latest surge in peripheral yields misses the point somewhat. Germany wants to introduce a default mechanism for states from 2013 onwards. Some observers suggest that this is the reason why investors have started to dump their peripheral bond holdings and blame Germany for talking about potential default. However, it is mostly the same obsevers who have been suggesting that there is no way around the perihperal countries defaulting anyway (and maybe leave the euro). The only thing which the German proposal changes is that they want to have an institutional set-up for the limits of Eurozone sovereign solidarity.

Overall, one should also not forget that if Germany does not demand any austerity measures/reforms in exchange for financial support, then nobody will. It seems that the smaller core countries (for example the Netherlands, Austria, Finland) have a similar line as Germany but in the current negotiations dont have the same power. As a result, if Germany were just to bail-out the rest of the periphery then yes, the peripheral debt crisis would be solved for the time being. But the prize to pay would be a massive rise in moral hazard issues, risking an even bigger debt crisis further down the road where no-one would be able to lend support.

Finally, I remain in favour of some sort of Eurobond (I suggested earlier joint issuance for the part of debt being within the Maastricht Treaty criteria) and do hope that Germany will give in on this. But also here, it matters a great deal that incentives to conduct a sustainable fiscal policy and to remain economically competitive become stronger and are not weakened further.

But to repeat: the biggest mistake by Germany is that it did not restructure its German banking sector. Germany is the voice of the fiscally sustainable and economically competitive countries. If these countries do not have this strong voice anymore, then the door to a fiscal union with much higher moral hazard issues as well as a higher propensity towards inflation and a lower propensity towards innovation and productivity is open. Germany has shown that they are able to negotiate, stand back from their toughest demands and support the common currency project if need be and so far it does not look likey they are deviating from that course.

Wednesday, December 1, 2010

Finally some good news

Some days ago Mr. Weber, the arch-hawk and president of the German Bundesbank, hinted that the European Financial Stability Facility could be increased in size in order to combat the woes in the Eurozone periphery. Furthermore Mr. Trichet, the president of the ECB, stated yesterday at a hearing in the European Parliament that "We will see what we decide" when referring to the ECB's bond buying program. Additionally, he suggested that markets would be underestimating EU government's determination to safeguard the Eurozone.

The statements by both, Mr. Weber and Mr. Trichet, are important. They suggest that the ECB now sees the need for more action in order to stabilise peripheral bond markets/economies, even though they will likely continue to disagree on the means to use. Mr. Weber seems to be preferring actions by the EU (i.e. an increase in the EFSF) while keeping the ECB out of this area whereas Mr. Trichet understands that the ECB has to and can provide significant support for financial stability.

I mentioned previously that I favor a significant quantitative easing program by the ECB (see Monetary easing in the wrong places or will the real ECB please stand up dated 17th November) - which could be put into practice straight away - and should be followed later on by joint Eurobond issuance for parts of the sovereign debt (i.e. up to 60% of GDP and up to a 3% deficit per year for each country) as mentioned in the last blog post.

A massive buying of peripheral bonds by the ECB would a) directly reduce peripheral bond yields and with that help to keep fiscal deficits in check and promote debt sustainability b) provide an effective floor for bond prices and hence increase incentives for investors to buy these bonds as well which renders financing of maturing debts/deficits for the peripheral countries easier. Given the prohibitively high interest rates on peripheral bonds, the monetary environment in the affected countries is currently very restrictive. Coupled with the ongoing fiscal tightening programs, this means that deflationary pressures have been rising. A significant reduction in these yields would just render the monetary environment less restrictive without causing inflationary risks.

Judging from Mr. Webers and Mr. Trichets comments, the discussion within the ECB about larger bond buying programme seems to be taking place at the moment and there is a good chance we will see some announcements being made at tomorrow's press conference. I expect some new measures (i.e. increased buying of peripheral bonds) but not to the extent which will really turn things around for good. Rather we are likely to get a timid response by the ECB, just enough to improve sentiment towards risky assets in general in the short term but not enough to provide a real lasting solution.

Still, in conjunction with an improving macro-environment in the US (the next weeks/months promise to see a slight growth rebound), the stage might be set for a year-end rally in equities.

The statements by both, Mr. Weber and Mr. Trichet, are important. They suggest that the ECB now sees the need for more action in order to stabilise peripheral bond markets/economies, even though they will likely continue to disagree on the means to use. Mr. Weber seems to be preferring actions by the EU (i.e. an increase in the EFSF) while keeping the ECB out of this area whereas Mr. Trichet understands that the ECB has to and can provide significant support for financial stability.

I mentioned previously that I favor a significant quantitative easing program by the ECB (see Monetary easing in the wrong places or will the real ECB please stand up dated 17th November) - which could be put into practice straight away - and should be followed later on by joint Eurobond issuance for parts of the sovereign debt (i.e. up to 60% of GDP and up to a 3% deficit per year for each country) as mentioned in the last blog post.

A massive buying of peripheral bonds by the ECB would a) directly reduce peripheral bond yields and with that help to keep fiscal deficits in check and promote debt sustainability b) provide an effective floor for bond prices and hence increase incentives for investors to buy these bonds as well which renders financing of maturing debts/deficits for the peripheral countries easier. Given the prohibitively high interest rates on peripheral bonds, the monetary environment in the affected countries is currently very restrictive. Coupled with the ongoing fiscal tightening programs, this means that deflationary pressures have been rising. A significant reduction in these yields would just render the monetary environment less restrictive without causing inflationary risks.

Judging from Mr. Webers and Mr. Trichets comments, the discussion within the ECB about larger bond buying programme seems to be taking place at the moment and there is a good chance we will see some announcements being made at tomorrow's press conference. I expect some new measures (i.e. increased buying of peripheral bonds) but not to the extent which will really turn things around for good. Rather we are likely to get a timid response by the ECB, just enough to improve sentiment towards risky assets in general in the short term but not enough to provide a real lasting solution.

Still, in conjunction with an improving macro-environment in the US (the next weeks/months promise to see a slight growth rebound), the stage might be set for a year-end rally in equities.

Friday, November 26, 2010

Watching the dominos fall

The adverse feedback loop (higher yields=weaker economy =higher default risk=higher yields) remains in full swing in the Eurozone periphery and the dominos are falling one after the other. If nothing changes, then Portugal will have to get a bail-out and after that Spain. With Spain, the capacity of the EFSF would be used up but the capacity of the market to cause more havoc will remain as the focus is likely to shift to Belgium and then Italy. At the latest with a potential bail-out of Spain, something has to happen. What are the options for the Eurozone?

A) Sovereign default: a sovereign default, be it for Greece, Ireland or any other Eurozone member would be disastrous at present. Should any sovereign default on its bond obligations, then the downward spiral would intensify even further and affect even more countries. Furthermore, the banking sectors of the core countries would be affected significantly - amid their holdings of peripheral debts - threatening the core economies. Given the adversity of this scenario, I am convinced that European authorities/politicians will do everything they can to prevent it from happening.

B) Significant quantitative easing by the ECB: As mentioned in my last blog post (Will the real ECB please stand up?), the monetary transmission mechanism in the Eurozone is not working properly. Should the ECB engage in massive quantitative easing (several hundred billions of peripheral bond buying), it could change the dynamics significantly. The ECB bond buying would depress peripheral bond yields sharply and help these sovereigns to continue financing its debt without needing a bail-out. Given such a massive ECB bond buying which breaks the adverse feedback loop, private investors could also move back on the buying side. This could be implemented very easily but the consensus within the ECB for such a course of action is not there (yet).

C) Joint Eurobond issuance. A fairly sensible solution would be to start with joint issuance. A new central agency would issue Eurobonds. Each country could finance up to the criteria set in the stability pact, i.e. up to a maximum outstanding amount of 60% relative to GDP and up to a maximum new issuance each year of 3% of GDP. Any financing needs exceeding these limits would continue to be financed via national bonds (i.e. Bunds, BTPs, BONOs etc.) which, however, would be subordinate to the Eurobonds. Given the much more limited outstanding amounts of the new national bonds, default on these bonds becomes more likely as the risk of contagion and the risk of a systemic financial sector crisis would be much lower. The credit risk and liquidity of these national bonds would be lower and hence yields higher, much higher for the peripheral countries. As a result, the market would continue to differentiate between issuers and hence there would be very strong incentives for each country to remain within the stability pact criteria (much stronger incentives than there were in the past). Additionally, if Eurobond issuance were to start now, the peripheral countries could refinance all their maturing debts and it would take several years before the 60% limit would be reached. The financing via national bonds would be very limited initially (only the part of the deficit exceeding 3%) and could probably be done - at high rates - with short maturity bonds. The implementation, though, seems difficult and there is no political will to engage in such a course of action (yet).

D) A doubling up of the EFSF: this would just prolong the current downward spiral. It would not break the adverse feedback loop (higher yields-weaker economy-higher default risk-higher yields) and the bail-outs would likely continue. However, it would still not be enough to deal with a potential bail-out of Italy. Such a doubling up per se would not offer a lasting solution. Alternatively, a doubling up + ECB buying to a much higher degree where a total of approx. EUR 2trn could be provided would be a different thing as it would guarantee financing and would reduce market rates.

E) A Eurozone break-up. Should the Eurozone break up, the most likely course of action would be for a formation of two separate currency areas (Euro north and Euro south). For a single country to leave, the economic costs would be almost unbearable. A weak country would lose all access to financial markets, could not service its EUR-denominated debts and would need to default. A strong country would see its new currency skyrocket, threatening to kill exports and the banking sector (because they hold a lot of assets denominated in the now weaker EUR). The only half-way realistic scenario would be for the northern block (Germany, Austria, Finland, Netherlands, Luxembourg, potentially Belgium) to form a new currency area which would limit the appreciation effects/reduce the loss of exports/devaluation of banking assets. On the other side a weak country could only leave as a group as well (Greece together with Spain, Portugal, Italy and maybe France) to form a new larger group with a meaningful internal economic and financial market which is still able to attract some foreign capital. However, for such a separation there would need to be a very strong political will (given the super high costs involved) and in turn a democratic legitimation to engage in such a course of action. But for such political movements to form, it needs time, i.e. some years.

Overall, amid the complexity, the costs involved and potential time it needs, a Eurozone break-up remains highly unlikely. Rather, the current path will continue to be taken up until a large country (probably Spain) needs a bail-out and the capacity of the EFSF is being used up. At that stage the political will to start with joint Eurobond issuance or the consensus within the ECB to engage in massive quantitative easing are likely to form, i.e. I think that the most likely scenario is the one of ECB QE (done in conjunction with a topping up in the EFSF), followed by joint Eurobond issuance. Together, I would assign these scenarios a probability of around 60-70%. Up to that point we can continue to watch the dominos fall.

A) Sovereign default: a sovereign default, be it for Greece, Ireland or any other Eurozone member would be disastrous at present. Should any sovereign default on its bond obligations, then the downward spiral would intensify even further and affect even more countries. Furthermore, the banking sectors of the core countries would be affected significantly - amid their holdings of peripheral debts - threatening the core economies. Given the adversity of this scenario, I am convinced that European authorities/politicians will do everything they can to prevent it from happening.

B) Significant quantitative easing by the ECB: As mentioned in my last blog post (Will the real ECB please stand up?), the monetary transmission mechanism in the Eurozone is not working properly. Should the ECB engage in massive quantitative easing (several hundred billions of peripheral bond buying), it could change the dynamics significantly. The ECB bond buying would depress peripheral bond yields sharply and help these sovereigns to continue financing its debt without needing a bail-out. Given such a massive ECB bond buying which breaks the adverse feedback loop, private investors could also move back on the buying side. This could be implemented very easily but the consensus within the ECB for such a course of action is not there (yet).

C) Joint Eurobond issuance. A fairly sensible solution would be to start with joint issuance. A new central agency would issue Eurobonds. Each country could finance up to the criteria set in the stability pact, i.e. up to a maximum outstanding amount of 60% relative to GDP and up to a maximum new issuance each year of 3% of GDP. Any financing needs exceeding these limits would continue to be financed via national bonds (i.e. Bunds, BTPs, BONOs etc.) which, however, would be subordinate to the Eurobonds. Given the much more limited outstanding amounts of the new national bonds, default on these bonds becomes more likely as the risk of contagion and the risk of a systemic financial sector crisis would be much lower. The credit risk and liquidity of these national bonds would be lower and hence yields higher, much higher for the peripheral countries. As a result, the market would continue to differentiate between issuers and hence there would be very strong incentives for each country to remain within the stability pact criteria (much stronger incentives than there were in the past). Additionally, if Eurobond issuance were to start now, the peripheral countries could refinance all their maturing debts and it would take several years before the 60% limit would be reached. The financing via national bonds would be very limited initially (only the part of the deficit exceeding 3%) and could probably be done - at high rates - with short maturity bonds. The implementation, though, seems difficult and there is no political will to engage in such a course of action (yet).

D) A doubling up of the EFSF: this would just prolong the current downward spiral. It would not break the adverse feedback loop (higher yields-weaker economy-higher default risk-higher yields) and the bail-outs would likely continue. However, it would still not be enough to deal with a potential bail-out of Italy. Such a doubling up per se would not offer a lasting solution. Alternatively, a doubling up + ECB buying to a much higher degree where a total of approx. EUR 2trn could be provided would be a different thing as it would guarantee financing and would reduce market rates.

E) A Eurozone break-up. Should the Eurozone break up, the most likely course of action would be for a formation of two separate currency areas (Euro north and Euro south). For a single country to leave, the economic costs would be almost unbearable. A weak country would lose all access to financial markets, could not service its EUR-denominated debts and would need to default. A strong country would see its new currency skyrocket, threatening to kill exports and the banking sector (because they hold a lot of assets denominated in the now weaker EUR). The only half-way realistic scenario would be for the northern block (Germany, Austria, Finland, Netherlands, Luxembourg, potentially Belgium) to form a new currency area which would limit the appreciation effects/reduce the loss of exports/devaluation of banking assets. On the other side a weak country could only leave as a group as well (Greece together with Spain, Portugal, Italy and maybe France) to form a new larger group with a meaningful internal economic and financial market which is still able to attract some foreign capital. However, for such a separation there would need to be a very strong political will (given the super high costs involved) and in turn a democratic legitimation to engage in such a course of action. But for such political movements to form, it needs time, i.e. some years.

Overall, amid the complexity, the costs involved and potential time it needs, a Eurozone break-up remains highly unlikely. Rather, the current path will continue to be taken up until a large country (probably Spain) needs a bail-out and the capacity of the EFSF is being used up. At that stage the political will to start with joint Eurobond issuance or the consensus within the ECB to engage in massive quantitative easing are likely to form, i.e. I think that the most likely scenario is the one of ECB QE (done in conjunction with a topping up in the EFSF), followed by joint Eurobond issuance. Together, I would assign these scenarios a probability of around 60-70%. Up to that point we can continue to watch the dominos fall.

Wednesday, November 17, 2010

Monetary easing in the wrong places or will the real ECB please stand up?

It should have been the ECB and not the US Fed which embarks on another round of quantiative easing.

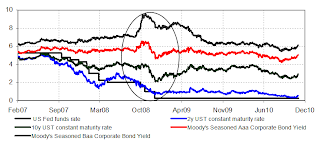

The US Federal Reserve has started their second round of Quantitative Easing which they announced at their last meeting. The first round of QE (and credit easing) was conducted in the wake of the Lehman bankruptcy. At that stage credit yields were rising despite a lower Fed funds rate and lower short-end UST yields (see chart below). These rising yields led to a further worsening of the fundamental situation and increased the risk of corporate bankruptcy which in turn led to higher yields: the negative feedback loop. As a result, the credit/quantitative easing efforts by the US Fed had a significant impact on market pricing and with that on the economy.

Now, however, neither the level of yields nor the availability of liquidity for the banking sector is holding back the economy. Bond yields have been at historic lows (such as for short-term yields) or at least close (at the longer end). Furthermore, credit-related yields are also at historic low levels, be it in nominal as well as in real terms. Additionally, banks continue to hold a significant amount of excess reserves. In turn, the effect of additional liquidity injection by the US Fed’s Treasury purchases on the real economy in the US should be limited. Rather, the economy is suffering from a lack of aggregate demand which could be eased by additional fiscal spending. But for that the political will is lacking. Overall, despite the additional monetary easing, the outlook for the US economy remains for an extended period of limited growth, but I see only a low risk for a double-dip in the next few quarters. Winter promises to see a slight rebound from the weaker numbers of the last months.

In the Eurozone, however, the ECB is keen to continue its exit from the exceptional liquidity support measures. This is also evident in the rising money-market rates. Several prominent members of the ECB/national Eurozone central banks also feel at unease with the historic low ECB repo rate.

Indeed, the overall Eurozone growth environment with growth at a non-annualised 0.4% in Q3 and yoy inflation currently running around 1.9% (1.1% for the core rate) suggests that it could withstand a somewhat less accommodative monetary policy environment. However, this is not how things work in the Eurozone. The Eurozone is a combination of unequal economies with the outperforming economies enjoying the most accommodative monetary environment and the underperforming economies suffering from the most restrictive monetary environment.

Most notably Germany could do with higher yields. It is one of my long-held believes that Germany is at the start of a multi-year high-growth period. Given that Germany has the lowest nominal bond yields, it has currently also the lowest real yields and in conjunction with a healthy growth environment, it is relatively easy for corporates and households to access credit. As Germany is outperforming, its monetary environment becomes even more accommodative, reinforcing the upswing.

For the ECB, this poses indeed a difficult task: The largest economy as well as the Eurozone average would demand a less accommodative environment but the peripheral countries need a more accommodative environment. With the help of their traditional rate setting, they only can lower the level of core bond yields. For the group of peripheral countries where the negative feedback loop is alive, the low repo rate environment has limited effects. If the ECB were up to a more activist stance, it could hike the repo rate but at the same time engage in massive credit (sterilised) or quantitative easing (non-sterilised) via buying of peripheral bonds. With that it would achieve both goals: a somewhat less accommodative environment for the economically sound and well-growing countries but a less restrictive stance for the periphery. Furthermore, the ECB’s support for secondary bond prices would also promote private sector demand for these instruments and limit contagion for other peripheral countries.

So far, the ECB bond buying has been very limited and was thereby not able to break the negative feedback loop. Unfortunately, I only see a low probability that the ECB will seriously step up its bond buying efforts given the prominent adversaries of the existing low-scale buying. Rather it seems likely that we continue facing a re-active ECB which will lead to an even easier monetary environment for the north-east but not the periphery. It should not be the US Fed which is engaging on another round of quantitative easing, it should be the ECB! But as it isn’t, the peripheral countries will continue to suffer from a very restrictive monetary policy environment. For the time being, we can continue to watch the Irish domino fall and once the bail-out has been announced, the focus can shift to Portugal and at a later stage to Spain.

The US Federal Reserve has started their second round of Quantitative Easing which they announced at their last meeting. The first round of QE (and credit easing) was conducted in the wake of the Lehman bankruptcy. At that stage credit yields were rising despite a lower Fed funds rate and lower short-end UST yields (see chart below). These rising yields led to a further worsening of the fundamental situation and increased the risk of corporate bankruptcy which in turn led to higher yields: the negative feedback loop. As a result, the credit/quantitative easing efforts by the US Fed had a significant impact on market pricing and with that on the economy.

US: Negative feedback loop in 2008/09, but not now

Now, however, neither the level of yields nor the availability of liquidity for the banking sector is holding back the economy. Bond yields have been at historic lows (such as for short-term yields) or at least close (at the longer end). Furthermore, credit-related yields are also at historic low levels, be it in nominal as well as in real terms. Additionally, banks continue to hold a significant amount of excess reserves. In turn, the effect of additional liquidity injection by the US Fed’s Treasury purchases on the real economy in the US should be limited. Rather, the economy is suffering from a lack of aggregate demand which could be eased by additional fiscal spending. But for that the political will is lacking. Overall, despite the additional monetary easing, the outlook for the US economy remains for an extended period of limited growth, but I see only a low risk for a double-dip in the next few quarters. Winter promises to see a slight rebound from the weaker numbers of the last months.

In the Eurozone, however, the ECB is keen to continue its exit from the exceptional liquidity support measures. This is also evident in the rising money-market rates. Several prominent members of the ECB/national Eurozone central banks also feel at unease with the historic low ECB repo rate.

Indeed, the overall Eurozone growth environment with growth at a non-annualised 0.4% in Q3 and yoy inflation currently running around 1.9% (1.1% for the core rate) suggests that it could withstand a somewhat less accommodative monetary policy environment. However, this is not how things work in the Eurozone. The Eurozone is a combination of unequal economies with the outperforming economies enjoying the most accommodative monetary environment and the underperforming economies suffering from the most restrictive monetary environment.

Most notably Germany could do with higher yields. It is one of my long-held believes that Germany is at the start of a multi-year high-growth period. Given that Germany has the lowest nominal bond yields, it has currently also the lowest real yields and in conjunction with a healthy growth environment, it is relatively easy for corporates and households to access credit. As Germany is outperforming, its monetary environment becomes even more accommodative, reinforcing the upswing.

Eurozone: Negative fedback loop is still alive (10y yields)

On the other side, for example Ireland has much higher nominal yields and given that it suffers from deflation (yoy inflation stood at -0.8% in October), has extremely high real yields. Furthermore, amid the ongoing deep recession, credit is much more difficult to come by for corporates and households. Both, the restrictive credit environment and the highly restrictive level of real yields are reinforcing the deleveraging process and thereby acting to slow down the economy further. This is debt-deflation at its best and results in a downward spiral with the worsening fundamental environment deferring investors, thereby leading to higher yields and with that to ever stronger deleveraging pressures and so on.For the ECB, this poses indeed a difficult task: The largest economy as well as the Eurozone average would demand a less accommodative environment but the peripheral countries need a more accommodative environment. With the help of their traditional rate setting, they only can lower the level of core bond yields. For the group of peripheral countries where the negative feedback loop is alive, the low repo rate environment has limited effects. If the ECB were up to a more activist stance, it could hike the repo rate but at the same time engage in massive credit (sterilised) or quantitative easing (non-sterilised) via buying of peripheral bonds. With that it would achieve both goals: a somewhat less accommodative environment for the economically sound and well-growing countries but a less restrictive stance for the periphery. Furthermore, the ECB’s support for secondary bond prices would also promote private sector demand for these instruments and limit contagion for other peripheral countries.

So far, the ECB bond buying has been very limited and was thereby not able to break the negative feedback loop. Unfortunately, I only see a low probability that the ECB will seriously step up its bond buying efforts given the prominent adversaries of the existing low-scale buying. Rather it seems likely that we continue facing a re-active ECB which will lead to an even easier monetary environment for the north-east but not the periphery. It should not be the US Fed which is engaging on another round of quantitative easing, it should be the ECB! But as it isn’t, the peripheral countries will continue to suffer from a very restrictive monetary policy environment. For the time being, we can continue to watch the Irish domino fall and once the bail-out has been announced, the focus can shift to Portugal and at a later stage to Spain.

Wednesday, November 10, 2010

A disintegrating Eurozone?

One disturbing development within the Eurozone is the reduction in internal trade flows as well as the domestication of some debt markets.

This FT article states that "Foreign holdings of Portuguese and Irish bonds fell to 65% of total debt at the end of the second quarter from 85% in 2009. They fell to 55% from 70% in Greece and to 38% from 43% in Spain during the same period." As foreigners stopped buying the bonds of these countries, domestic institutions (mostly banks, but apparently also pension funds and insurance companies) were buying them.

As a result holdings by other countries of these bonds fell. The table below shows the foreign assets of the German banking sector of other Eurozone countries at the end of 2008 as well as in September this year and the %-changes. In combination, German banks reduced their holdings of assets in Greece, Ireland, Portugal and Spain by more than 15% whereas they increased the assets relating to neighbouring Eurozone countries by almost 5%. Furthermore, they also decreased the assets of the other southern European countries, most notably Italy.

As a result holdings by other countries of these bonds fell. The table below shows the foreign assets of the German banking sector of other Eurozone countries at the end of 2008 as well as in September this year and the %-changes. In combination, German banks reduced their holdings of assets in Greece, Ireland, Portugal and Spain by more than 15% whereas they increased the assets relating to neighbouring Eurozone countries by almost 5%. Furthermore, they also decreased the assets of the other southern European countries, most notably Italy.

German banks' foreign assets holdings (in €mln)

| Dec 2008 | Sep 10 | %-change | |

| Belgium | 25.392 | 31.700 | 20% |

| Finland | 8.401 | 8.713 | 4% |

| France | 152.400 | 171.338 | 11% |

| Greece | 28.550 | 29.044 | 2% |

| Ireland | 188.051 | 157.519 | -19% |

| Italy | 144.257 | 115.338 | -25% |

| Luxembourg | 191.005 | 189.383 | -1% |

| Malta | 7.643 | 7.154 | -7% |

| Netherlands | 118.075 | 120.170 | 2% |

| Austria | 76.688 | 78.098 | 2% |

| Portugal | 27.859 | 25.665 | -9% |

| Slowakia | 2.727 | 2.809 | 3% |

| Slovenia | 4.425 | 3.593 | -23% |

| Spain | 176.909 | 149.762 | -18% |

| Cyprus | 8.017 | 7.021 | -14% |

| SP,GR,IR,PO | 421.369 | 361.990 | -16% |

| AT,NL,FR,BE,LU | 563.560 | 590.689 | 5% |

| IT,FI,SL,SL,CY,MA | 175.470 | 144.628 | -21% |

| Total | 1.160.399 | 1.097.307 | -6% |

Source: German Bundesbank

But also in terms of trade flows, a similar picture emerges. The table below shows the German exports and imports from June-Aug 2010 compared to the same period in 2007. Exports to Portugal, Ireland, Greece and Spain decreased by almost one fourth, highlighting the weak state of these economies. However, imports from these countries also dropped by a significant 7%. In contrast, German exports to its neighbouring Eurozone countries (France, Netherlands, Austria, Belgium, Luxembourg) increased slightly by 2% whereas imports from neighoubirng countries increased by a significant 6%. In between is the group of non-SGIP/non-neighbouring Eurozone countries (Italy, Finland, Slovenia, Slovakia, Malta, Cyprus) where Germany saw its exports drop by almost 8% and imports drop by 3%. Interesting is also the development of German trade flows vs. its non-Eurozone neighbours (Poland, Denmark, Czech Republic, Switzerland, Liechtenstein) which have increased significantly vs. 2007.

German imports and exports Jun-Aug 2010 in €bn & %-changes vs. same period 2007

Source: German Statistics Office, Research Ahead

Source: German Statistics Office, Research Ahead

Yes, Germany is exporting its improved business environment via higher imports, but mostly to its neighbouring countries and less to the fiscally challenged SGIP.

Overall, the combination of the changes in cross-border holdings of financial assets as well as in the composition of trade flows suggests that the group of fiscsally challenged countries - Spain, Greec, Ireland, Portugal - is seeing its economic ties with the rest of the Eurozone weaken significantly, i.e. to some degree they have been disintegrating from the rest of the Eurozone. As a result, so far they could not profit that much from the economic rebound in the north-eastern Eurozone countries.

On the other side, the already rather strong economic integration of the north-eastern Eurozone countries is intensifying further.

Should these economic developments run further - disintegration of the fiscally challenged economies from the rest of the Eurozone, intensifying integration of the economically stronger north-eastern countries - political realities could start to mirror these developments via the formation of a north-eastern political club with a weakening of the will for ongoing support measures to the rest of the Eurozone.

Overall, the combination of the changes in cross-border holdings of financial assets as well as in the composition of trade flows suggests that the group of fiscsally challenged countries - Spain, Greec, Ireland, Portugal - is seeing its economic ties with the rest of the Eurozone weaken significantly, i.e. to some degree they have been disintegrating from the rest of the Eurozone. As a result, so far they could not profit that much from the economic rebound in the north-eastern Eurozone countries.

On the other side, the already rather strong economic integration of the north-eastern Eurozone countries is intensifying further.

Should these economic developments run further - disintegration of the fiscally challenged economies from the rest of the Eurozone, intensifying integration of the economically stronger north-eastern countries - political realities could start to mirror these developments via the formation of a north-eastern political club with a weakening of the will for ongoing support measures to the rest of the Eurozone.

Wednesday, November 3, 2010

German Wirtschaftswunder revisited

I have been arguing for a long time that the multi-year outlook for the German economy is extremely positive (see for example There is more to celebrate for Germany from Nov last year or German Wirtschaftswunder 2.0 from May this year). In the meantime, economic data out of Germany has surprised most economists and investors. While growth projections have been revised upwards, I remain convinced that the outlook for the German economy (and thus for German real and financial assets) is by far much more favorable.

There are various reasons why this is the case:

a) German corporates have become extremely competitive over the past decade. During the first years of EMU they had to largely regain competitiveness vs. the rest of the Eurozone as Germany locked in an uncompetitive exchange rate when the euro was formed and German corporates were heavily in financial deficit following the debt-financed M&A boom during the dot-com bubble. In turn, at the start of the last decade German corporates had to restructure (i.e. cut costs - especially via headcount reduction in Germany and offshoring/outsourcing) to regain cost competitiveness and reduce the financial deficit. Unfortunately, as Germany regained internal competitiveness during the last decade, the external value of the euro soared, especially vs. key competititors such as Japan. However, over the past 2 years, the euro has lost altitude - again especially vs. key competitors - and German corporates for the first time since the start of EMU are competitive on an intra-Eurozone and on an extra-Eurozone basis. Additionally, German corporates on aggregate have moved from a financial deficit into a financial surplus.

b) German households have been burdened over the past decade by the restructuring of the corporate sector and the numerous reforms by the state of amongst others the labour market, the unemployment benefits as well as the pension systems. In combination they had the effect of rising the financial risks carried by each individual (via lower job security and lower social security), temporarily increasing unemployment and reducing wage growth. All this put downward pressure on the sum of wages earned and upward pressure on the German savings ratio, in turn creating an environment of weak domestic demand. However, now the sum of wages earned is increasing (as unemployment dropped sharply and we are likely to enter an upcycle in wage growth) while no more significant structural reforms are on the agenda. In turn, the outlook for consumption growth has become favorable as well for the first time since the start of EMU.

c) The Germans state was forced to carry through numerous structural reforms as well as several rounds of fiscal tightening to reduce the structural fiscal deficit. However, at present the situation of German state finances is relatively healthy and in turn the need to carry through fiscal tightening measures is limited. The German government decided to engage on a 4-year tightening programme, but on average the tightening amounts to only approx. 0.25% of GDP per year. Furthermore, as the economy is doing better than anticipated, fiscal deficits are undershooting the projected levels by a significant margin.

d) At the start of EMU, Germany had a high price level which combined with weak economic developments resulted in below-average inflation and thus in above-average real yields, further restraining the economy. Now, however, the German economy is roaring ahead which should lead to inflation being more in-line with the Eurozonea average. Additionally, intra-Eurozone sovereign spreads are very high and as a result, Germany is enjoying the lowest real yields within the Eurozone. Finally, as the outlook for the German economy is favorable, credit conditions are easing. As a result, for the first time since the start of EMU, Germany enjoys a very accommodative monetary environment.

What is more, all of these factors re-inforce each other. While at the beginning of the last decade this lead to a vicious circle whereby weakness in the corporate sector, the household sector, a restrictive fiscal and monetary environment all reinforced each other, we are now just at the beginning of a virtuous circle.

The strength in the corporate sector is leading to more employment and with that wage and consumption growth. The outlook for the domestic economy is thereby improving, leading corporates to invest more and banks to provide more funds (as the perceived credit risk is lowered). The fiscal deficit is reduced which reduces the need for fiscal tightening/opens the door for fiscal easing. Domestic inflation picks up which - given that Germany outperforms the rest of EMU - leads to lower real yields, further promoting more investments and a lower savings ratio. Within the monetary union if a country starts to outperform in economic terms, its monetary environment becomes even more accommodative not less, further reinforcing the upswing.

Given the favorable starting point for Germany in terms of corporate competitiveness and low private sector indebtedness such a virtuous circle can last for years without leading to cost disadvantages and/or over-indebtedness.

We are just at the start of this virtuous circle where the drop in unemployment - due to the export led growth rebound - starts to fuel wage gains and coupled with low real yields promotes a reduction in the savings ratio. This will create an increasingly favorable environment for domestic demand and lead to the next wave in growth. I remain convinced that Germany will show above trend growth for the next 3-5 years. While there will be ups and downs in quarterly growth numbers, I continue to look for growth to average around 2.5-3%.

There are various reasons why this is the case:

a) German corporates have become extremely competitive over the past decade. During the first years of EMU they had to largely regain competitiveness vs. the rest of the Eurozone as Germany locked in an uncompetitive exchange rate when the euro was formed and German corporates were heavily in financial deficit following the debt-financed M&A boom during the dot-com bubble. In turn, at the start of the last decade German corporates had to restructure (i.e. cut costs - especially via headcount reduction in Germany and offshoring/outsourcing) to regain cost competitiveness and reduce the financial deficit. Unfortunately, as Germany regained internal competitiveness during the last decade, the external value of the euro soared, especially vs. key competititors such as Japan. However, over the past 2 years, the euro has lost altitude - again especially vs. key competitors - and German corporates for the first time since the start of EMU are competitive on an intra-Eurozone and on an extra-Eurozone basis. Additionally, German corporates on aggregate have moved from a financial deficit into a financial surplus.

b) German households have been burdened over the past decade by the restructuring of the corporate sector and the numerous reforms by the state of amongst others the labour market, the unemployment benefits as well as the pension systems. In combination they had the effect of rising the financial risks carried by each individual (via lower job security and lower social security), temporarily increasing unemployment and reducing wage growth. All this put downward pressure on the sum of wages earned and upward pressure on the German savings ratio, in turn creating an environment of weak domestic demand. However, now the sum of wages earned is increasing (as unemployment dropped sharply and we are likely to enter an upcycle in wage growth) while no more significant structural reforms are on the agenda. In turn, the outlook for consumption growth has become favorable as well for the first time since the start of EMU.

c) The Germans state was forced to carry through numerous structural reforms as well as several rounds of fiscal tightening to reduce the structural fiscal deficit. However, at present the situation of German state finances is relatively healthy and in turn the need to carry through fiscal tightening measures is limited. The German government decided to engage on a 4-year tightening programme, but on average the tightening amounts to only approx. 0.25% of GDP per year. Furthermore, as the economy is doing better than anticipated, fiscal deficits are undershooting the projected levels by a significant margin.

d) At the start of EMU, Germany had a high price level which combined with weak economic developments resulted in below-average inflation and thus in above-average real yields, further restraining the economy. Now, however, the German economy is roaring ahead which should lead to inflation being more in-line with the Eurozonea average. Additionally, intra-Eurozone sovereign spreads are very high and as a result, Germany is enjoying the lowest real yields within the Eurozone. Finally, as the outlook for the German economy is favorable, credit conditions are easing. As a result, for the first time since the start of EMU, Germany enjoys a very accommodative monetary environment.

What is more, all of these factors re-inforce each other. While at the beginning of the last decade this lead to a vicious circle whereby weakness in the corporate sector, the household sector, a restrictive fiscal and monetary environment all reinforced each other, we are now just at the beginning of a virtuous circle.

The strength in the corporate sector is leading to more employment and with that wage and consumption growth. The outlook for the domestic economy is thereby improving, leading corporates to invest more and banks to provide more funds (as the perceived credit risk is lowered). The fiscal deficit is reduced which reduces the need for fiscal tightening/opens the door for fiscal easing. Domestic inflation picks up which - given that Germany outperforms the rest of EMU - leads to lower real yields, further promoting more investments and a lower savings ratio. Within the monetary union if a country starts to outperform in economic terms, its monetary environment becomes even more accommodative not less, further reinforcing the upswing.

Given the favorable starting point for Germany in terms of corporate competitiveness and low private sector indebtedness such a virtuous circle can last for years without leading to cost disadvantages and/or over-indebtedness.

We are just at the start of this virtuous circle where the drop in unemployment - due to the export led growth rebound - starts to fuel wage gains and coupled with low real yields promotes a reduction in the savings ratio. This will create an increasingly favorable environment for domestic demand and lead to the next wave in growth. I remain convinced that Germany will show above trend growth for the next 3-5 years. While there will be ups and downs in quarterly growth numbers, I continue to look for growth to average around 2.5-3%.

Friday, October 22, 2010

Blog Reactivation

I hope to become more active again with this blog from now on. Please apologize for the temporary blackout period but I have been busy with other ventures. In the meantime I also updated my website www.researchahead.com (English version) and www.researchahead.de (German version).

Any feedback appreciated.

Any feedback appreciated.

All Good Things Come to an End

I remain sceptical with respect to the economic effects of QE2. Subdued growth is here to stay for a prolonged period in the US as households will deleverage further whereas the government sector has to rein in its deficits over the medium term. Additionally, I don’t expect inflationary pressures to grow meaningfully over the foreseeable future. There is ample spare capacity as can be seen for example by the high unemployment rate and with muted Growth this is unlikely to change soon. Furthermore, the money being created by the next round of QE will likely lead to another significant rise in banks’ excess reserves and in turn not hit the real economy. As a result, there will continue to be too many goods being chased by too little money. The main effect of QE will be to support asset prices/reduce yields. However, the example of Japan has shown that low yields per se do not help much in fuelling aggregate demand or inflation if it does not fuel credit creation (see chart below).

Japanese monetary aggregates and economic activity (avg yoy change 1995-2000)

Source: IMES

Source: IMESIn turn, US nominal growth should remain at historically low levels, warranting also low nominal bond yields for an extended period of time. My fundamental fair-value range for 10y UST remains at 2.50-3.00%. I was looking for UST yields to trade around the lower end of this range into autumn and for a low point to be reached during November before yields would be rising to the high end of the range during the winter months. A key reason for this assessment is economic seasonality. During autumn the economy usually re-accelerates following the summer lull. However, as the economy operates significantly below potential, this seasonality should not be as pronounced as is usually the case. In turn, I expected seasonally adjusted data for September and October to come in on the weak side. So far this is indeed playing out and economic data suggests that the US has significantly lost momentum going into autumn. But as the chart below shows with the help of the US employment report data, this seasonal effect is reversing during the winter months with generally weaker economic activity. As a result, I expect that seasonally adjusted economic data will increasingly paint the picture of an improving growth environment for the next few months (especially for December/January).

Given that the US Federal Reserve is now likely to embark on another round of QE just before this seasonality effect kicks in, the combination an even looser monetary policy with apparently improving economic environment will likely propel nominal bond yields sharply higher, i.e. well above the upper end of my fair-value range. Additionally, the prospects for QE2 have been mirrored by a marked shift in positioning in the UST market. Long duration position as measured by non-commercial longs in the US bond futures market or as measured by the JP Morgan survey of US institutional investors have become rather consensus and are at the highs for the year. Furthermore, whereas the technical picture up to the 10y part of the curve still looks supportive of ongoing yield drops, the developments in the 30y sector are sending a clear warning signal.

The combination of a likely improvement in the macro-economic picture over the next few months, significant long positions as well as a worsening technical picture for ultra-long bonds suggests that the bull-market in UST is likely coming to an end soon. I think that the low pint in 30y UST yields is already behind us whereas for shorter-dated Treasuries this does not yet seem to be the case. I expect yields to continue falling over the next 2-3 weeks amid weakfish economic data and given the upcoming Fed meeting with the likely start of QE2. However, it seems prudent to lighten up on longs already at this point in time and I reducie the long-held UST longs by half, looking to close the remaining longs at slightly lower yield levels over the next 2-3 weeks.

Economic activity usually weakens during winter

Source: BLS, Research Ahead

Given that the US Federal Reserve is now likely to embark on another round of QE just before this seasonality effect kicks in, the combination an even looser monetary policy with apparently improving economic environment will likely propel nominal bond yields sharply higher, i.e. well above the upper end of my fair-value range. Additionally, the prospects for QE2 have been mirrored by a marked shift in positioning in the UST market. Long duration position as measured by non-commercial longs in the US bond futures market or as measured by the JP Morgan survey of US institutional investors have become rather consensus and are at the highs for the year. Furthermore, whereas the technical picture up to the 10y part of the curve still looks supportive of ongoing yield drops, the developments in the 30y sector are sending a clear warning signal.

The combination of a likely improvement in the macro-economic picture over the next few months, significant long positions as well as a worsening technical picture for ultra-long bonds suggests that the bull-market in UST is likely coming to an end soon. I think that the low pint in 30y UST yields is already behind us whereas for shorter-dated Treasuries this does not yet seem to be the case. I expect yields to continue falling over the next 2-3 weeks amid weakfish economic data and given the upcoming Fed meeting with the likely start of QE2. However, it seems prudent to lighten up on longs already at this point in time and I reducie the long-held UST longs by half, looking to close the remaining longs at slightly lower yield levels over the next 2-3 weeks.

Forming upward trend in 30y UST yield is sending a warning signal

Source: Bloomberg, Research Ahead

Source: Bloomberg, Research AheadWhereas in the US, the technical market outlook is darkening from the ultra-long end, in the Eurozone, it is the short end which has been guiding yields higher. The chart below shows that the 2y Schatz yield marked a low in June and has since been forming on a rising trend. Furthermore, the downward trend which started in June last year has been broken to the upside by now. 10y Bund yields, however, formed their low at the beginning of September and so far have only just broken through the downward trend in place since March this year. I have been looking for such a significant underperformance of German Bunds compared to their US counterparts. The reason for these diverging trends between the US and the Eurozone should be seen in the diverging economic behaviour as well as the clearly different stance of the ECB compared to the US Fed. For one, the Eurozone economy is doing relatively fine amid the strong growth of especially Germany. Furthermore, the ECB does not see further monetary easing as being warranted and seems rather happy about the waning interest in its liquidity provision measures. As a consequence the excess liquidity in the Eurosystem has been dropping significantly, putting upside pressures on ultra-short end yields and leading 3m rates back above the ECB’s 1% repo rate for the first time since mid-2009.

In light of this less accommodative monetary environment and given the ongoing favourable outlook for the North-Eastern Eurozone economies, especially Germany, the fundamental environment in the Eurozone will be increasingly favouring higher yields . As a result, German Bund yields have likely seen their yield lows across the curve and – similar to the US – should rise substantially during the next few months. Amid the tighter monetary environment as I expected initially, I raise my fair-value range for 10y Bunds from 2.25-2.75% previously to 2.50-3.00% and expect a test of the upper end during early 2011. In turn, I would close the remaining long positiions and establish first strategic short duration positions with a view of 3-6 months. The bearish development should be led by the 5y sector of the curve with the 2-5y spread stable to higher and the 5-30y spread likely to move to flatter levels.

Bearish developments in the Eurozone emanate from the short-end

Source: Bloomberg, Resesarch Ahead

In light of this less accommodative monetary environment and given the ongoing favourable outlook for the North-Eastern Eurozone economies, especially Germany, the fundamental environment in the Eurozone will be increasingly favouring higher yields . As a result, German Bund yields have likely seen their yield lows across the curve and – similar to the US – should rise substantially during the next few months. Amid the tighter monetary environment as I expected initially, I raise my fair-value range for 10y Bunds from 2.25-2.75% previously to 2.50-3.00% and expect a test of the upper end during early 2011. In turn, I would close the remaining long positiions and establish first strategic short duration positions with a view of 3-6 months. The bearish development should be led by the 5y sector of the curve with the 2-5y spread stable to higher and the 5-30y spread likely to move to flatter levels.

Monday, June 21, 2010

Importance of SGIP for North-Eastern economies is low

It is well-known that sovereign defaults in Spain, Greece, Ireland and Portugal would have devastating effects on the financial sectors of the rest of the Eurozone. However, I am convinced that while technically these countries might be insolvent they will not need to default given that the EU/IMF/ECB measures will keep them liquid. As I argued in the previous post (see Intra-Eurozone competitiveness: A solvable task) especially Spain, Portugal and Ireland have a high probability of being able to restore competitiveness and bringing their fiscal deficits back on a sustainable path over a period of 3-5 years whereas the outlook for Greece remains more challenging. The price to pay will be a longer-lasting deflationary recession and a significant increase in the sovereign debt-GDP ratio. However, especially for Spain and Ireland this should not be such a big problem as the starting debt-GDP ratio has been fairly low.

For the banking sector of the other Eurozone countries the fact that SGIP remain liquid and do not need to default while the ECB provides a floor to government bond prices means that the losses they incur are limited. Furthermore, the banks can slowly offload parts of their sovereign debt via the ECB's bond buying and as the EU/IMF refinance the maturing GGBs. Finally, the rising private sector defaults in SGIP will occur over a number of years and the sums involved appear manageable for the Eurozone financial sector.

What remains for the rest of the Eurozone are the economic effects from reduced demand by SGIP. I hear frequently that given Germany is such a big exporter and given SGIP are in a longer-lasting recession, Germany cant grow amid lack of export demand. However, it seems that no one looked at the data as this is just not true.

The table below shows the share of exports going into a particular region relative to total exports for various Eurozone countries. Due to data availability it covers only export of goods but not services (services account for about 20% of all exports). It highlights that the share of exports going to SGIP relative to overall exports is low for most Eurozone countries. In 2008 Germany exported only 6.6% of all exports to SGIP. This has come down further in 2009 to below 6% (EUR48bn vs. total exports of EUR808bn). According to Bundesbank data for services, the picture is the same. Germany exported 6.2% of all exports in services to SGIP in 2008 and 5.6% in 2009 (EUR 9.3bn vs. a total of EUR165.5bn). Except Portugal, due to the high export share going to Spain, only France and Italy have a share of more than 10%. As a side note, the UK – even though not being a Eurozone member - has a share of more than 12% of exports going into SGIP. Overall, demand weakness emanating from SGIP should not have a dramatic effect on the rest of the Eurozone.

Furthermore, exports of goods in the magnitude of more than 20% compared to GDP go outside the Eurozone for Germany, Austria, Finland, Belgium and the Netherlands. Together these countries account for 42% of Eurozone GDP vs. only 18% for SGIP. Furthermore, these exporters have relatively low fiscal deficits and in turn only a limited need for fiscal tightening. France and Italy face a less positive environment as they have a lower share of exports going outside of the Eurozone but will be impacted relatively more by the loss in demand emanating from SGIP and have higher fiscal deficits.

Furthermore, exports of goods in the magnitude of more than 20% compared to GDP go outside the Eurozone for Germany, Austria, Finland, Belgium and the Netherlands. Together these countries account for 42% of Eurozone GDP vs. only 18% for SGIP. Furthermore, these exporters have relatively low fiscal deficits and in turn only a limited need for fiscal tightening. France and Italy face a less positive environment as they have a lower share of exports going outside of the Eurozone but will be impacted relatively more by the loss in demand emanating from SGIP and have higher fiscal deficits.

Moreover, the Euro has weakened considerably on a trade-weighted basis which should give a significant boost to the exporters within the Eurozone and therefore for more than 40% of Eurozone GDP. Besides the weakening of the trade-weighted Euro which is based on trade relationships, the Euro has weakened even more vs. the currencies of key competitors. For example the direct trade relationships between the Eurozone and Japan are limited (accounting for 2% of all exports in goods and 3.5% of imports), but Japan is a key competitor in important industries such as cars and machinery. The fall by roughly 30% in the EURJPY cross rate over the past two years means that Eurozone exporters have become significantly more competitive in a short time-period. In turn, Eurozone exports should profit not only from Eurozone goods & services having become cheaper for its trade partners (or alternatively Eurozone corporates being able to increase their margins), but also that Eurozone goods have become much cheaper vs. close substitute products. Both factors should act to boost demand for Eurozone exports.

Consequently, we are likely to face a Eurozone economy where 18% (SGIP) will remain in a longer-lasting recession, 42% (the exporters) face strong external demand and Italy/France (accounting for 38% of GDP) will be able to muddle through. So far, the Eurozone’s current account has been close to zero amid very high deficits in Spain, Portugal, Greece and to a lesser extent France counterbalanced by substantial surpluses in Germany and the Netherlands. Going forward, the Eurozone current account promises to move into a significant surplus amid significantly lower deficits in Portugal, Spain and Greece and very high surpluses in Germany, the Netherlands and to a lesser extent, Finland, Austria and Belgium.

For the banking sector of the other Eurozone countries the fact that SGIP remain liquid and do not need to default while the ECB provides a floor to government bond prices means that the losses they incur are limited. Furthermore, the banks can slowly offload parts of their sovereign debt via the ECB's bond buying and as the EU/IMF refinance the maturing GGBs. Finally, the rising private sector defaults in SGIP will occur over a number of years and the sums involved appear manageable for the Eurozone financial sector.

What remains for the rest of the Eurozone are the economic effects from reduced demand by SGIP. I hear frequently that given Germany is such a big exporter and given SGIP are in a longer-lasting recession, Germany cant grow amid lack of export demand. However, it seems that no one looked at the data as this is just not true.

The table below shows the share of exports going into a particular region relative to total exports for various Eurozone countries. Due to data availability it covers only export of goods but not services (services account for about 20% of all exports). It highlights that the share of exports going to SGIP relative to overall exports is low for most Eurozone countries. In 2008 Germany exported only 6.6% of all exports to SGIP. This has come down further in 2009 to below 6% (EUR48bn vs. total exports of EUR808bn). According to Bundesbank data for services, the picture is the same. Germany exported 6.2% of all exports in services to SGIP in 2008 and 5.6% in 2009 (EUR 9.3bn vs. a total of EUR165.5bn). Except Portugal, due to the high export share going to Spain, only France and Italy have a share of more than 10%. As a side note, the UK – even though not being a Eurozone member - has a share of more than 12% of exports going into SGIP. Overall, demand weakness emanating from SGIP should not have a dramatic effect on the rest of the Eurozone.

Furthermore, exports of goods in the magnitude of more than 20% compared to GDP go outside the Eurozone for Germany, Austria, Finland, Belgium and the Netherlands. Together these countries account for 42% of Eurozone GDP vs. only 18% for SGIP. Furthermore, these exporters have relatively low fiscal deficits and in turn only a limited need for fiscal tightening. France and Italy face a less positive environment as they have a lower share of exports going outside of the Eurozone but will be impacted relatively more by the loss in demand emanating from SGIP and have higher fiscal deficits.

Furthermore, exports of goods in the magnitude of more than 20% compared to GDP go outside the Eurozone for Germany, Austria, Finland, Belgium and the Netherlands. Together these countries account for 42% of Eurozone GDP vs. only 18% for SGIP. Furthermore, these exporters have relatively low fiscal deficits and in turn only a limited need for fiscal tightening. France and Italy face a less positive environment as they have a lower share of exports going outside of the Eurozone but will be impacted relatively more by the loss in demand emanating from SGIP and have higher fiscal deficits.Euro has been weakening especially vs. competitors